$18 billion or ₹1.5 lakh crore per year.

That’s how much India is losing to port congestion every year. A staggering amount (and it would take quite a bit of time counting all the zeros).

That’s when I realized we’ve been looking at the problem all wrong when thinking about port congestion in the Indian Ocean.

We often assume that building more infrastructure is the solution. But that’s just a surface fix. The real issue is the fragmented systems that operate these ports. Instead of just adding capacity—more berths, larger yards—we need to focus on integrating systems that can work together seamlessly.

In India, 63% of shipments are delayed due to port congestion, a staggering number for a region that is home to the world’s third-largest waterway. Despite this, the Indian Ocean remains a bottleneck for trade, weighed down by systemic inefficiencies.

Beyond Infrastructure: The Complexities of Port Congestion in India

Blaming port congestion solely on infrastructure is like treating the symptoms of a disease while ignoring the root cause. The reality is far more complex: outdated cargo tracking systems and tangled regulatory red tape are strangling India’s port efficiency.

Yet, these factors rarely make headlines. Does your neighbor knock on your door to tell you this?

Just kidding, but let’s get back to the real issue.

Beyond Infrastructure Problems

It’s easy to point fingers at inadequate ports, but what about the archaic systems managing them? The “Make in India” initiative has transformed the country into a manufacturing hub, yet this surge in trade has exposed a critical gap: logistical foresight.

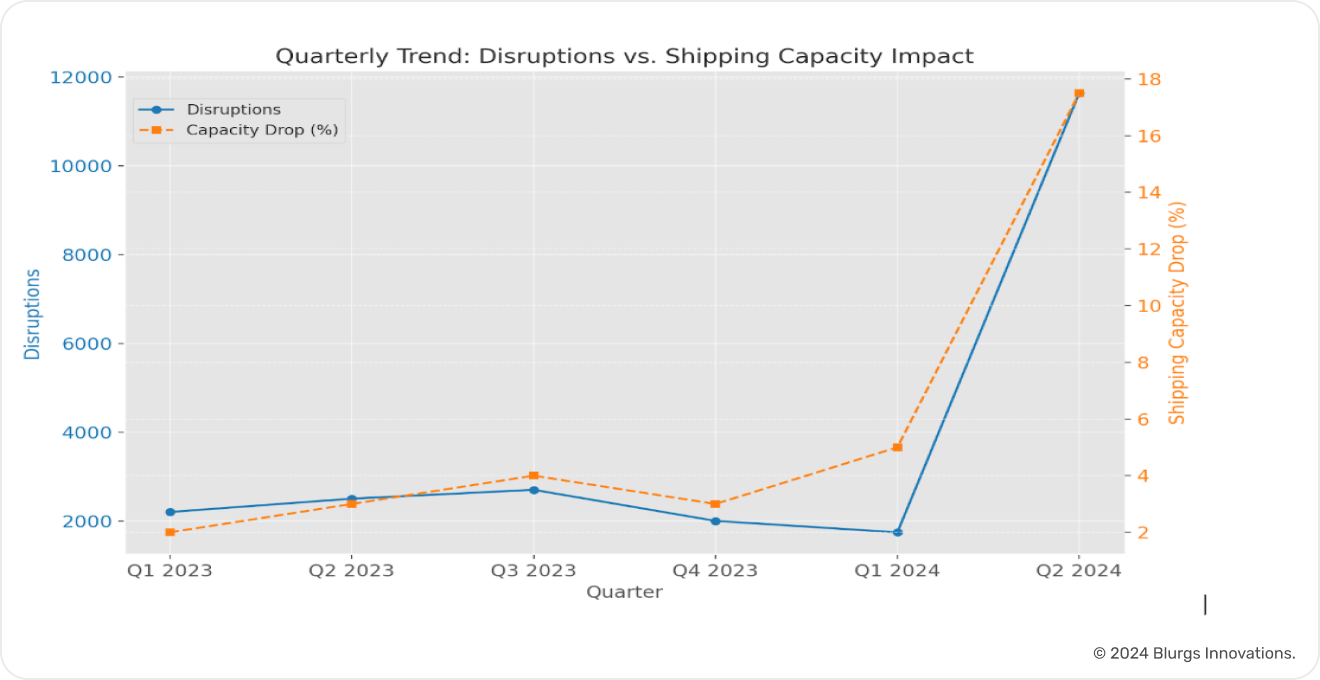

In 2023-24, major Indian ports handled approximately 532.6 million tonnes (MT) of cargo—a 6% increase from the previous year. However, we’re moving goods faster than we can process them, with average release times for exports at 7.3 days in 2023.

Geopolitical Strain

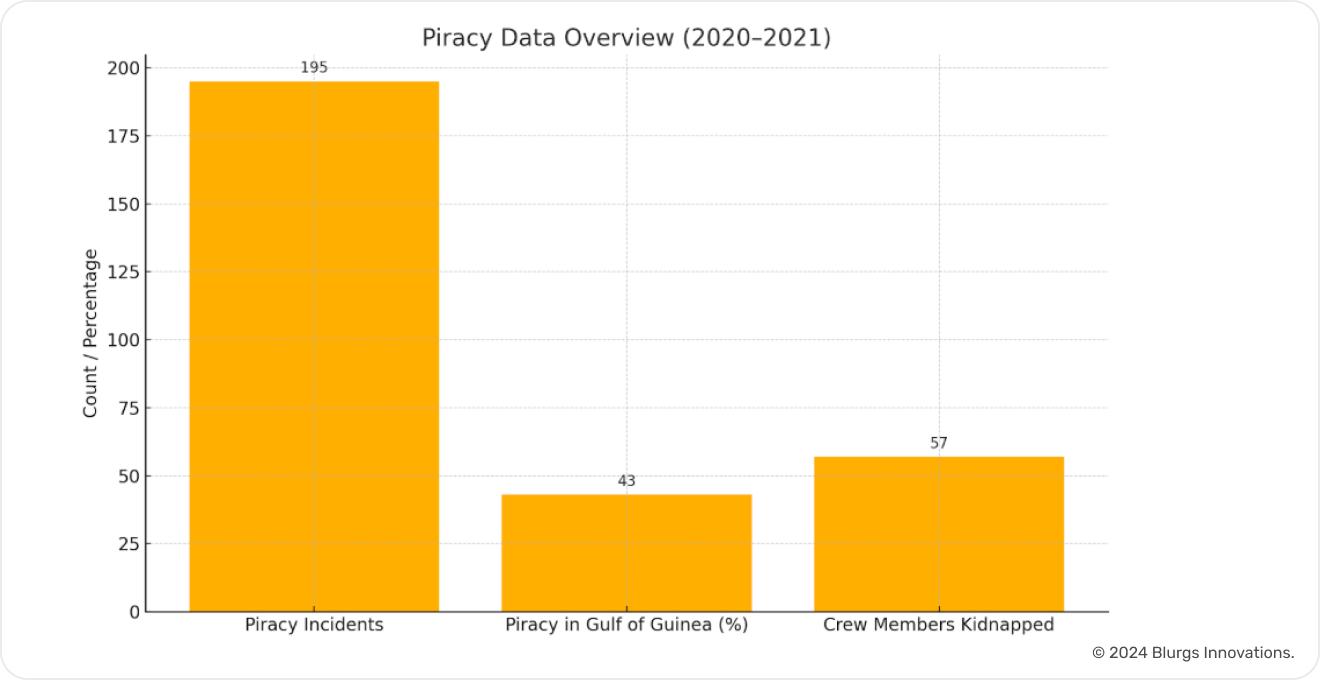

The complexities don’t stop at India’s shores. The country is caught in a geopolitical tug-of-war, as China’s Belt and Road Initiative reshapes trade routes across the Indian Ocean. Countries are scrambling to realign their maritime strategies, especially post-QUAD Summit.

Ports like Mundra and JNPT now find themselves at the center of an increasingly crowded chessboard.

The Invisible Congestion

Then there’s the issue no one’s talking about: invisible congestion. As transshipment hubs, Indian ports like Mundra and JNPT are facing bottlenecks that aren’t immediately visible. Dwell times—when containers sit idle awaiting processing—are quietly wreaking havoc on supply chains. These delays inflate costs at every stage.

Economic Impact

The ripple effects of these inefficiencies are staggering. Every hour a container sits idle, costs snowball across the supply chain, contributing to inflation—a consequence that’s rarely accounted for in the congestion narrative.

AI and Digital Ecosystems: The Future of Smart Port Operations

Ports don’t just need digitalization—they need a full-scale digital transformation.

Simply integrating data won’t solve congestion if the systems remain fragmented. While the maritime industry has focused on data integration for efficiency, without intelligence, integration is just noise. AI-driven solutions can do more than just tell you what’s happening—they predict what’s going to happen and how to avoid it.

Predictive models, for example, allow port operators to forecast disruptions and preemptively adjust operations. Knowing about a potential bottleneck before it hits or rerouting vessels in anticipation of bad weather is the kind of proactive decision-making that AI enables.

While many ports are still catching up with basic automation, the real frontier is cognitive AI. These systems learn from historical patterns and real-time data, optimizing supply chains and making smart, real-time decisions.

The Case for a Digital Maritime Ecosystem

Today, port authorities, shipping companies, customs, and logistics providers are trapped in data silos, which leads to inefficiencies. To overcome this, we need a digital maritime ecosystem—a shared platform where real-time data is accessible to all stakeholders, allowing for better coordination and decision-making.

Smart Ports for Global Leadership: A Vision for India

Remember when you were a kid and didn’t get to play because you were the youngest, even though you knew you were better? You just wanted to scream, “I can do this!”

India is standing at a similar crossroads. We can either remain a secondary player in global trade or seize the moment to lead.

I believe India has the potential to lead in smart port innovation—outpacing regional competitors and challenging their dominance.

The Geopolitical Advantage

By developing smart ports that integrate advanced AI, IoT, and blockchain technologies, India can turn its strategic location into a powerful competitive advantage. We could create a network of ports that not only move goods efficiently but also offer unmatched transparency, security, and predictive capabilities.

Sustainability as a Competitive Edge

The conversation around smart ports often focuses on technology, but the real game-changer is sustainability. Ports powered by renewable energy, designed for minimal environmental impact, and equipped with energy-efficient infrastructure could redefine what it means to be a world-class port.

Blockchain for Transparency

Transparency in port operations has long been a weak link in global trade, with inefficiencies, fraud, and misreporting costing the industry billions. Blockchain technology can be the transformative solution—a decentralized system where real-time data is accessible to all stakeholders, eliminating fraud and drastically reducing customs clearance times.

Lessons from Lagos: What India Must Avoid

Building bigger ports doesn’t solve congestion—it just shifts the bottleneck. The Port of Lagos, despite major investments in physical infrastructure, still struggles with chronic congestion.

Why? Because outdated tracking systems, fragmented operations, and a lack of real-time data sharing have not been addressed.

This inefficiency costs Nigeria around $19 billion annually. The lesson from Lagos is clear: digital transformation must come first. India’s ports need an integrated digital strategy that connects every link in the supply chain—before building new terminals

Digital First, Concrete Second

The lesson from Lagos is clear: digital transformation must come first. Before building new terminals, India’s ports need an integrated digital strategy that connects every link in the supply chain—from port authorities to shipping lines and logistics providers.

This means investing in technologies like AI-driven analytics to streamline operations and adapt flexibly to changing trade dynamics.

Steering Toward a Smarter Maritime Future

It’s time to shift our perspective—from blind industrialization to intelligent integration. Port congestion is a symptom of a system struggling to keep up with modern trade demands. Short-term fixes aren’t enough. We need to dive into strategies that can truly modernize India’s ports and unlock their full potential.

Ready to explore the future? Download our eBook, “Dead Reckoning: The AI Takeover of Maritime Operations,” for actionable insights on building a smarter, more resilient maritime network.